Traditional energy is gradually depleted and global warming is getting worse. Building renewable and sustainable energy systems has become a global consensus. As a significant segment of clean energy, the development potential of PV should not be underestimated. According to EnergyTrend, there would be 200-220 GW new installed capacity and 80-85MT polysilicon capacity including 20-30 MT new capacity come online in 2022. The supply and the demand of polysilicon would in structural tight equilibrium. Considering of production release, dual control policy, and facilities maintenance, the new capacity of polysilicon is limited in 2022 H1. It is because the limited capacity and the terminal rigid demand that the polysilicon will remain the tight balance and the price would maintain high. With the release of expanded capacity, the tight tendency would be alleviated at the end of 2022 Q2, and the price may usher in an inflection point and fall soon.

Under the background of global energy transition, the development of renewable energy is important. More than 130 countries have announced their carbon neutral targets. Some have adopted legislation to clarify their responsibilities in order to effectively address the crisis and challenges posed by climate change. The penetration rate of renewable energy is relatively low with broad development potential. In addition, PV has economic advantages. The levelized cost of energy (LCOE) is lower than traditional power. Thus, the market share of PV will continually increase. According to TrendForce’s analysts, in the context of global clean energy booming, there will be 150~170 GW new installed PV capacity in 2021. In 2022, it would increase by about 30% YOY and reach 200-220GW.

According to expansion plans published by polysilicon enterprise, the global capacity is expected to reach 80-85 MT by the end of 2022. With the new added capacity coming on stream, supply and the demand of polysilicon will in a tight equilibrium and balanced structurally in 2022. In view of TrendForce, the new capacity of polysilicon is about 20-30 MT. Considering the impact of production ramp-up, dual control policy, and facilities maintenance, the polysilicon market will in a tight equilibrium and balanced structurally in 2022. Furthermore, the tight balance tendency would remain because of the limited supply and increasing terminal rigid demand. With the gradual release of expension capacity, The tightening trend will be eased in Q2 next year. The most of expansion projects would reach full production in 2022 Q2. The supply is expected to match the demand with a surplus. Compared with downstream industries, the capacity of polysilicon is the smallest. Becasue the expansion of polysilicon take longer time. It is difficult to meet the demands of wafers, cells and modules in a short time. The mismatch in supply and demand will continue to occur constantly .

Supply expansion in 2022 is limited. Some of it has been locked in long-term contracts in the form of quantity lock based on real-time prices. There is not much polysilicon available in the market. Moreover, the installed demand is growing.Thus, the supply-demand balance may remain tight in the first half of 2022. Therefore, the price may remain high.

The newly added capacity is able to come online in 2022, potentially easing the situation in the second quarter. Therefore, the turning point is expected to be at the end of Q2 in 2020. After supply meets the downstream demand of rigid installation, the output of polysilicon may be surplus by the time of Q3 and Q4. If so, the price will fall steadily. When will the price of polysilicon fall below RMB200/Kg is dependent on the release of expansion projects. Price will fall when the newly added capacity come online.

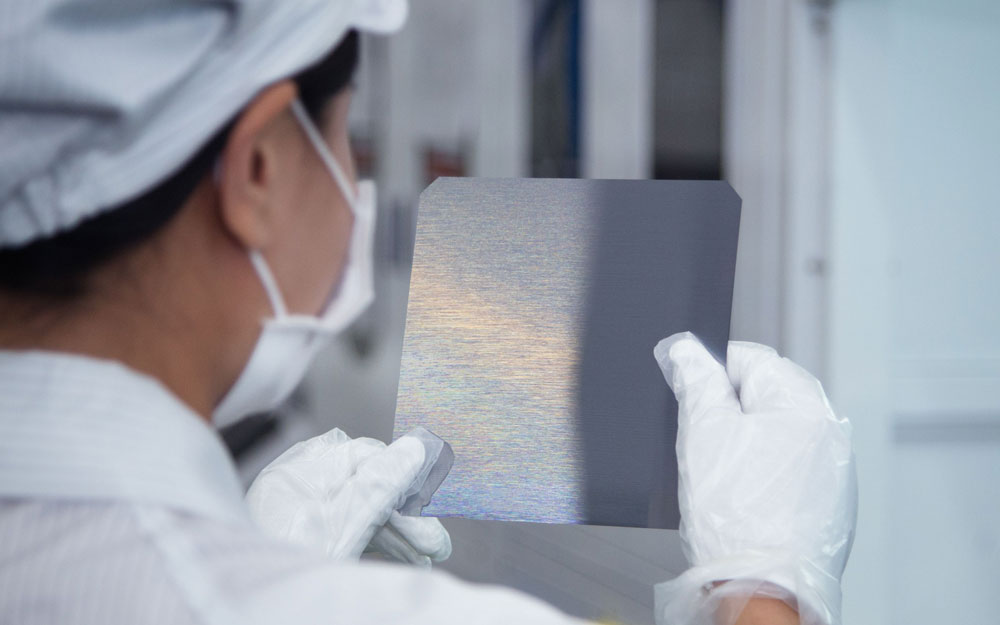

Granular silicon has advantages in theoretical cost and energy consumption, quality, and continuity crucible loading. As a complement to traditional polysilicon, it increases the supply of polysilicon. However, the quality of granular silicon is lower than the Siemens method. There is still a certain gap. Moreover, it has not been able to mass-produce due to the high costs. It is expected that its penetration rate will increase to about 10%-15% in 2022. With the improvement of polysilicon and wafer production facilities, the market share of granular silicon is expected to further expand.

Due to patent issues, it is only GCL and Shaanxi Youser Group using granular silicon technology. According to their expansion plan, by the end of 2022, their total capacity will reach 19.2 MT. So far, Longi, Zhonghuan Solar, Shuangliang have the intention to buy granular silicon from GCL. For instance, JA Solar has announced that they will purchase a total of 14.58MT of granular silicon in the next five years from GCL.